July 2023 Recap at Oakridge Real Estate

Posted by Oakridge Real Estate on Monday, August 7th, 2023 at 2:56pm.

July 2023 Recap at Oakridge Real Estate

Another month of 2023 is complete and we are ready to share our July 2023 recap! Our July Recap is filled with stats, our new Etsy Shop, appraisal information from our friends at Greenstate Credit Union, July top performers, July listing of the month, what you need to know about your tax bill, Summer in the Cedar Valley at Lost Island Theme Park, and a market misconceptions that our team wants you to know about. Here's to another month of doing what we love in the Cedar Valley!

Oakridge Monthly Recap & Inventory Levels

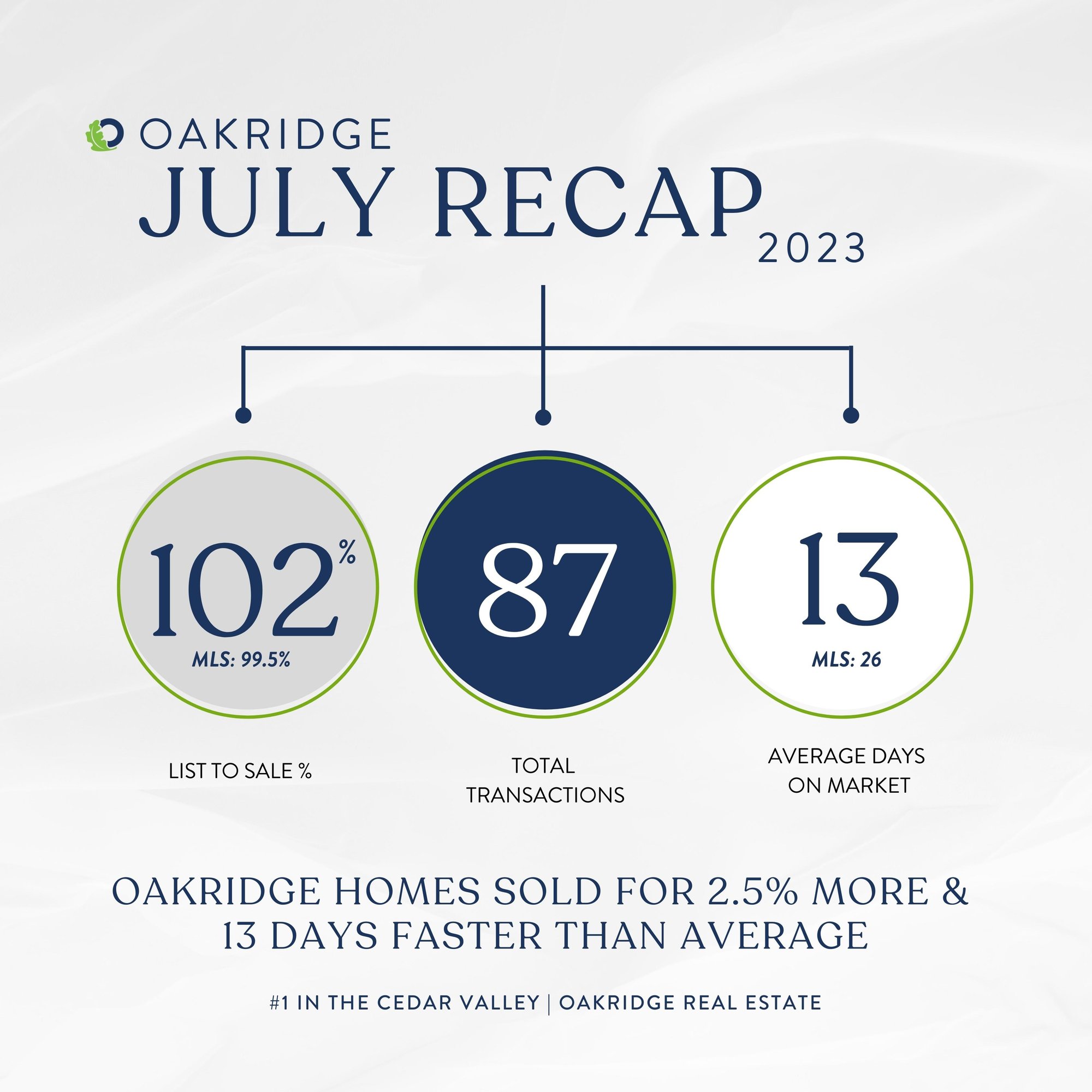

The summer market is here in the Cedar Valley. With 87 transactions completed by our team we the Cedar Valley market continues to stay active and busy for both buyers and seller. When it comes to getting your home sold you can rely on our team of trusted Realtors. In July homes listed by an Oakridge Agent sold for an average 102% of their list price and sold in an average of 13 days. That is 2.5% MORE and 13 days faster than the MLS average. Our MLS is the Northeast Iowa region consisting of 107 offices and 800+ Realtors.

We have an Etsy Shop!

We are excited to share that we have an Etsy Shop, Acorn Designs Studio! Because home is more than the purchase date but what you fill it with, we created a line of digital custom art and instant downloads to make your house feel like home. Everything was designed in mind to fit any home, style, or current decor. You can explore our shop for yourself here!

Understanding Appraisals. Our friends at GreenState Credit Union are Answering Some Common Questions When it Comes to Appraisals.

A home appraisal may sound similar to a home inspection, but they’re very different services.

Home inspections are designed to protect you by offering information on the home’s condition before you buy it. Appraisals protect you and the lender by confirming the home’s value and ensuring it aligns with your purchase price and loan amount if you are obtaining a mortgage.

Here’s what happens during an appraisal and how it can impact your home purchase.

Q: What is an appraisal?

A: An appraiser is engaged by the lender, if you are obtaining a mortgage loan. They will evaluate the home’s features, layout, conditions and other details — inside and out. They will also likely use public data and recent sales in the area, all to determine the home’s value.

Q: Why are appraisals necessary?

A: Appraisals are important because lenders need to know how much they can lend you for a property. Loaning you more than the home is worth could mean a financial loss since you wouldn’t necessarily be able to sell the home and pay off the balance. But the appraisal benefits you as a buyer, too, because you may not want to buy a home that’s overpriced.

Q: How much does an appraisal cost?

A: The cost for an appraisal is between $350 and $750, depending on the location and nature of a property. The fee is part of your closing costs as disclosed by your lender.

Q: What happens if an appraisal is too low?

A: If the home you’re trying to buy is appraised at a lower value than its list price or your offer, you have a few options. You can renegotiate with the seller, pay the difference out of pocket with cash, or potentially void the contract based upon guidance from your real estate agent. There are protections you can put into place as a buyer at the time of offer as well in the event of a low appraisal.

Reach out if you have more questions about appraisals or the homebuying process in general. We’re here to help.

July Top Performers

Congrats to our July top performers! Top performers include; Ann Lyons, Bethany Benner, Bob Delveau, Bryn Mangrich, Carl Ericson, Dan Berregaard, Josh & Sarah Bey, Luke & Becky Bartlett and Sara Junaid.

July Listing of the Month: This Home in Cedar Falls Has Even the Seasoned Realtors in Awe

.jpg)

Each month we pick a listing from our team to highlight. July's Listing of the Month is this immaculate home in Cedar Falls! I think it goes without saying why we this home was picked. With close to 6,000 square feet, grand living area, breathtaking kitchen, a dream spa like primary suite, full completed basement and many more amazing features, there is nothing this home doesn't offer. See the full blog post and more of this home here!

Listed by Gale Bonsall, 319.231.9700

Tax Bills: What You Need to Know When Receiving Your Annual Tax Bill

It is that time of year when everyone in the Cedar Valley will be receiving their tax bill in the mail. Did you know that your tax "bill" is a bill that doesn't necessarily need to be paid? More times than not your property taxes are tied into your monthly mortgage payment, known as escrow. Before sending in any payment make sure to check with your lender to see if you have this tied into your mortgage payment.

Want to save a little money on your property taxes? Then you need to apply for a Homestead Tax Credit! A Homestead Tax Credit could grant you up to $200 a year that can be put toward property taxes. This can be done online or by going to your county assessor's office. This is only applicable if the address you are filing for is your primary residence. You will need a copy of the deed to your home in order to apply.

Summer in the Cedar Valley: Lost Island Theme Park

All summer long we have been highlighting our Oakies favorite places in the Cedar Valley. While on Tuesday tour in July we made a fun stop to spend some time at Lost Island Theme Park in Waterloo. If you haven't been before, all of our Oakies give it a 10/10 rating, even those that are not rollercoaster junkies.

Market Misconceptions

When it comes to the real estate market, especially in the Cedar Valley, there are few misconceptions that our Oakies are hearing! Throughout July we are going to shed a little light on those misconceptions and let you in on what is really going on in the Cedar Valley housing market! This week Troy Olson is talking about the difference between a home being dated vs in bad shape!

.png)